Middle office for accompanying clients in the bank. Back office, front office and middle office

“All professions are needed, all professions are important” - we all know this from childhood. The fact is that in the modern world everything is interconnected, so many terms of foreign origin have appeared, the meaning of which is unknown to most citizens. Realtors, image makers, copywriters, mine surveyors - you can't tell right away what these people are doing. The same can be said about the back office and front office specialists. Who are they, where do they work, what is their direct responsibility?

Defining the front office of a financial institution

This term refers to a group of departments in organizations that are responsible for working with customers or clients. The front office specialists are at the forefront, they are the face of the company. The success of the entire institution depends on their professionalism, competence, and friendliness. Such employees are engaged in processing applications for or obtaining a loan, advising on any issues, distributing banking products, etc. That is, specialists constantly accompany the client from the moment he arrives at the bank branch until the conclusion of the transaction.

What is Back Office?

This is the operational and accounting unit that is responsible for ensuring the work of the branches that manage the assets and liabilities of the company. The back office is a gray cardinal. Clients and customers cannot appreciate the work of its specialists, although they put a lot of effort into the prosperity of the business. There are such subdivisions in banks, investment companies, organizations making transactions on the securities markets. They employ from 3 to 15 people, the number of employees depends on the size of the institution.

The work in the back office of the bank involves the preparation of the execution of settlements for securities and money for transactions concluded by the front office. Also, its employees are engaged in monitoring compliance with limits, maintaining internal report, providing information for accounting. The back office specialist works only with counterparties, he does not cooperate with clients.

What does the middle office do?

This division can be called the link between the front and back offices. Its functions are rather vague. Bank specialists are mainly involved in drafting and signing contracts, providing clients with various types of reports, accepting orders for withdrawing funds, buying and selling, etc. Also, the middle office is responsible for coordinating standard forms and regulatory documents with other departments, developing methods conducting new operations. In most cases, its specialists work on assignments from the foremost.

What are the responsibilities of back office professionals?

Employees of financial institutions must draw up contracts for the purchase and sale of securities, keep a register of transactions. The specialist monitors the re-registration of securities, since the transfer of property rights to the buyer from the seller must be made. The back office performs this procedure based on the transfer order contained in the register of the securities holder.

The new owner should get everything required documents, and the specialist, in turn, controls the settlement process between the companies of the seller and the buyer. A huge responsibility is placed on the back office employee, because the slightest mistake, which at first glance seems to be an insignificant inaccuracy, can lead to large-scale problems. In the worst case, the company incurs significant losses due to the invalidation of the transaction.

Comparison of front and back offices

These two divisions are opposite to each other. The front office is the face of the company. Specialists are always in sight, the future of the organization depends on their professionalism and resourcefulness. The back office is a shadow job. The employees of the unit do not know everything by sight, but they, like toiling bees, shovel many important things. All specialists work for the good of the company, but it is still important to draw a line between different departments so as not to shift the responsibilities of some onto the shoulders of others.

Front office and back office have different functionality. The first one works on increasing the speed of customer service, maintaining the reliability of the information received, and promptly registering sales. The second is focused on the analysis of sales, preparation of a card index of goods with prices, a pricing system, control of the movement of products in warehouses.

The division of subdivisions can take place both at the software and at the hardware level. There is no clear border between them, it is just a system of concepts. Separation of back and front offices is necessary on a psychological level. The head of the company must understand that more professional and experienced specialists are required to work in the first subsystem than in the second, since they are entrusted with greater responsibility and more difficult work.

"Avankor: Middle-office" - the solution provides control on a daily basis key indicators activities of the organization in the financial and stock markets.

The system automates all the necessary functions performed by the Middle Office, interacts with the Avankor: Trust Management and Avankor: Mutual Funds modules. The system is developed on Platform 1C: Enterprise 8, the "Client-Server" architecture, thin client is supported.

Key objectives:

- Providing management accounting for the fund's financial investments, separate from the accounting;

- Collection and processing of primary data;

- Using a flexible designer for preparing reports by the user;

- Monitoring the efficiency of activities in the financial markets;

- Control of restrictions and established limits on financial investments.

System interaction scheme

Description of the scheme:

1. Information about transactions and operations in the real estate market.

2. Information about transactions in the market.

Broker data and OTC trades. Information about prices and reference data

3. Information about open accounts, deposits, INN transactions.

4. Transmission of primary data to MIDL.

5. Reporting to clients

Functions performed:

Avankor mutual fund:

1. Accounting for shareholders;

2. Accounting of transactions;

3. Reporting to clients.

Avankor DU:

1. Processing of market data;

2. Accounting;

3. Loading and storage of reference data;

4. Preparation of reports for clients.

Avankor MIDL:

1. Post-control of limits;

2. Assessment of investment efficiency;

3. Management accounting;

4. Internal accounting.

Asset directories

The system can use the following types of assets:

- stocks and bonds;

- investment units;

- depositary receipts;

- mortgage certificates of participation;

- futures and options;

- structured products;

- real estate objects;

- requirements and obligations;

- settlement accounts, deposit accounts, brokerage accounts, incl. in foreign currency.

Detailed release information is available for each asset in the directory.

Available details for assets:

- ISIN;

- reg. number;

- par value and number of securities in the issue;

- the issuer's industry;

- exchanges on which the paper passed the listing procedure;

- cash flows on the "body" of the bond and coupon;

- underlying asset information for structured products;

- specification of fixed-term contracts;

It is possible to automatically fill in the details using various services for providing information.

The configuration can receive and store data on corporate events (defaults, offers, reorganizations, AGM, etc.)

List of maintransactions andoperations:

- Transactions in the stock, foreign exchange and derivatives markets;

- Repayment, including partial and early repayment (securities, deposits, INN transactions);

- Payment of transaction costs;

- Receipt, disposal and transfer between cash accounts;

- Conversion of securities issues;

- REPO transactions;

- Clearing (receipt / write-off of variation margin);

- Reflection of requirements and obligations;

Non-marketoperations:

- Input / output to asset management, transfer between asset portfolios;

- Downloading quotes, exchange rates and corporate events;

- Calculating the fair and amortized cost of assets;

- Entering initial balances into the system.

Forecast trades

The possibility of making a forecast transaction / transaction with an asset is provided.

At the same time, analytical indicators (including amortized costs) are calculated for the forecast period, taking into account the entered forecast values \u200b\u200band expected flows on deposits and bonds.

Asset prices

The system provides a constructor of algorithms for determining fair prices.

There is the possibility of algorithmicizing complex approaches to determining fair prices.

Built-in reporting forms are represented by a wide range:

- Portfolio investment performance;

- Operations report;

- Payment schedule;

- Calculation of profitability using the MWR and TWR methods;

- Portfolio Management Performance Report;

- etc.

Risk management

Flexible setting of limits to control restrictions on the structure of the investment portfolio.

Key parameters of limits are configured by the user in accordance with the requirements of the legislation of the Russian Federation,

or in accordance with the requirements of the organization's risk management system.

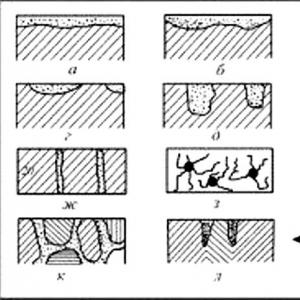

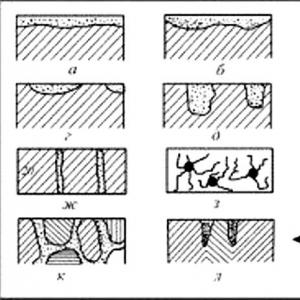

Fig. 1 Portfolio structure

Fig. 2 Portfolio Limits Check

Integrationwith servicesInterfax

The system allows you to automatically receive regulatory and reference information (securities cards, stock exchange quotes, ratings of issuers and securities, etc.) from the RU DATA service and the MICEX.

Unloading for stress tests of the Bank of Russia

The system allows you to upload data in any format using a flexible constructor of reporting forms.

Administration

Data exchange takes place fully automatically in the background according to a specified schedule.

Informing about the presence of data exchange failures by sending letters to the mail.

Implemented standard exchange rules between systems.

Flexible differentiation of user access rights to objects at the record level.

There are three offices in any investment bank: Front Office, Middle Office and Back Office. In this article, we will tell you what it does and how each department works.

Front Office interacts directly with customers. The main task of Front office employees is to conclude deals with institutional and private clients that will bring profit to the bank and increase the assets of the clients themselves.

Front Office employees work for primary and secondary financial markets.

The investment bank's primary market includes a corporate finance department (IBD - Investment Banking Department), where bankers provide advice and services on raising finance and restructuring clients' businesses. They are involved in mergers and acquisitions (M&A), capital raising (Equity Capital Markets) and client debt restructuring (Debt Capital Markets).

Secondary market consists of Trading, Sales and Research departments. Front Office is characterized by strict separation of corporate finance and trading departments in order to limit the exchange of information between departments and to avoid conflicts of interests between the client and the bank through the use of inside information.

Front Office Feature:

· Work is associated with stress and constant stress - huge amounts of money depend on the decisions of employees, which they have to make in a short period of time.

· A lot of! A lot of work! Front Office employees are real careerists and workaholics. Working 80-100 hours a week is the norm for them.

· Work in the Front Office of an investment bank is one of the most prestigious and highly paid in an investment bank.

Middle Office deals with technical and administrative support. Inside it is divided into sections.

In the risk management department, analysts and risk managers work closely with the front office teams to provide them with updated information on various financial products and financial markets. This information helps employees to minimize investment risks.

The preparation financial statements the quality control department (product control).

The Middle Office also includes a legal department (compliance), which monitors legal support of transactions and the requirements of the regulator - the Central Bank. They also manage legal risk by ensuring that the bank's practices adhere to laws and industry standards.

Liquidity, operational and reputational risks are managed by the treasury department.

Middle Office Feature:

· Great responsibility! If the front office employees are more responsible for financial indicators, then in the middle office they are responsible for the bank's compliance with all legal rules and requirements. The reputation of the bank largely depends on the quality of their work.

· Negotiating with the front office. Middle Office employees often have to warn the front office about high risks and convince them to abandon unreasonably risky deals.

Back Office- this is the department of transaction support, management and quality control.

The Operation & Settlement department is responsible for checking transactions for errors and customer payments.

Administrative functions include work with personnel (HR), marketing, brand formation and promotion, adherence to quality standards for the provision of services in all bank offices.

Also an important part of the back office is the IT department, which deals with issues technical support, improvement and automation of processes, correction of technical problems.

Back Office Feature:

· Normalized working hours, as opposed to the front office.

· Interaction with other offices of the bank. International banks often bring together teams around the world to quickly address the challenges posed.

· Employees face constant work deadlines. Yet the work is not as stressful and intense as in the front office.

We will tell you more about the work of each Front office department in one of the following materials.

/ Your tPeople team /

When carrying out credit activities of a banking institution, it is important to differentiate the functions of bank employees in order to avoid a situation where one person is responsible for the final result of a particular banking operation.

The bank's lending process is multi-stage and requires both the collection of information about clients, the assessment of relevant documentation, constant communication with clients, and the preparation of various types of agreements and regular credit monitoring. To do this, each step of the loan process must be well thought out and distributed among the loan officers.

Lending authority can be delegated in various ways. In particular, authority can be distributed among individual employees of the credit department, groups of employees, or different departments. The process of delegating credit authority is complex as it requires not only an appropriate response from the loan officer to the needs of the borrower, but also the necessary qualifications and decision-making ability.

In the activities of the credit department, the following areas of work can be distinguished to assign a certain number of employees to each of them:

Preparation and drafting of instructions for lending;

Evaluation of loan applications and the conclusion of loan agreements;

Credit management and credit monitoring;

Credit rehabilitation;

Loan portfolio analysis;

Drawing up reports on lending;

Management of risks.

Each employee assigned to one or another section should perform only those functions that are provided specifically for him. Only clerks who are responsible for managing the risk of lending should be involved in all areas.

The procedure for carrying out each credit operation should be based on such principles as the availability of permission, recording, control and must include the following components: description of the operation; distribution of powers between the executors of the operation; establishing the responsibility of persons who carry out a credit transaction; documenting information on the operation; internal control measures over the credit transaction and other components determined by the bank and approved in the internal banking regulations.

The distribution of functions in the credit process and the delegation of responsibilities between bank employees can be carried out through the following bank divisions: front office, back office, and middle office.

Front office is a bank's division or its authorized persons who initiate and organize a banking operation (through the conclusion of appropriate agreements). Front office refers to the divisions that directly serve customers and generate cash flow. In the credit process, the front office is the initiator, it is here that the preliminary and preparatory stages of crediting are carried out.

The front office performs the following functions in the process of lending to clients:

Search and attraction of clients;

Referral of clients to the relevant loan officer;

Study of the possibility of expanding the consumption of bank services by the client;

Control over the fulfillment by the client of the obligations that were assumed by him in connection with the conclusion of the loan agreement (transition to servicing, attracting the bank to structures, partners related to the client, expanding the consumption of bank services, etc.

In order to attract customers, front-office units should use all available marketing tools:

Direct contact with the client in his environment;

Analysis of the current client base of the bank in order to identify potential consumers of the bank's credit services;

Expansion of cooperation with existing borrowers;

Establishing relationships with business partners of bank clients and the like.

The front-office division should work closely with the marketing and product divisions of the bank to agree on the directions for promoting credit products and attracting customers.

Given the significant growth rates of the lending business, banking institutions are paying much attention to the automation of the lending process. At the same time, the automation of the activities of the bank's front-office divisions during the issuance and maintenance of a loan is of particular importance.

The activity of the bank's front office begins with the arrival of the client at the bank branch, processing the loan application and ending with the formation of the transaction. The functions of the credit front office should also include the processes of servicing the loan agreement in terms of interaction with the client, such as: work with applications for connecting services, restructuring the agreement, early repayment, providing account statements, etc. At the same time, the organization of the front office includes not only the automation of the operator's workplace, but also the provision of appropriate software products for all departments when making a decision on a loan, including the moment of forming an agreement. This is due to the fact that, as part of the loan issuance process, the operator, in addition to entering the application and the borrower's questionnaire, selects products and services, negotiates the terms of the contract with the client, as well as forms a package of documents. At the same time, in parallel with the clerk, other divisions of the bank are also involved in the procedure for issuing a loan, in particular, the security service, the legal department, and the retail lending department. In addition, the following system operations are performed, such as scoring and checking the borrower in various databases. A typical loan disbursement process involving various divisions of the bank's front office is depicted in Figure 4.4.

Loan issuance processes differ depending on the direction of the business, the cost of the product, the class of the borrower, the local market, the development strategy of the banking institution and other factors, and as a result, the approach to automating various business processes is different.

R and C. 4.4. at A typical process for issuing a loan with the participation of divisions of the bank's front office

at the same time, with consumer lending, which is characterized by large volumes of low-cost loans and quick decisions to provide them, the decision-making process requires minimal involvement of bike departments. At the same time, much attention is paid to credit scoring, automatic checks in external databases, reducing the burden on the operator by introducing a preliminary scoring procedure at the client's request. With car loans, the need for a loan calculator increases to select the most acceptable loan conditions for the borrower. In the process of automating the credit process for issuing credit cards, there can be a large number of similar business processes that differ in the types of cards and credit conditions.

During the granting of mortgage loans, the most complex automated business processes with the participation of third-party organizations (mortgage brokers, insurance companies, subjects of appraisal activities), which maintain a voluminous document flow and a significant number of checks by the bank's divisions. In mortgage lending, as part of the credit process, not only the borrower is assessed, but also guarantors, guarantors and the like.

The main differences in the automation of retail lending processes by front-office divisions in different areas of business are shown in table 4.2 (see p. 96).

An effective approach to automating front-office lending diarrhea is their preliminary processing, taking into account the direction of the bank's development. The main prerequisites for automating front-office operations are: an increase in the volume of loans granted to borrowers and the need to process a significant number of loan applications; expanding the sales network using the lending process, connecting new points of sale, transitioning to a large-scale structure, entering new local markets; the use of complex lending processes with a large document flow, a multilevel decision-making procedure; the desire of banking institutions to reduce the number of loan defaults through the use of a newly developed system for assessing the borrower's creditworthiness, and the like. At the same time, the automated system of the bank's front-office lending operations should be flexible enough, make it possible to manage it and allow automating any nuances of the credit process, since it is the difference from standard procedures that gives the bank a competitive advantage. The timeliness of the introduction of an automated system is important for making a decision on granting a loan, which will make it possible to more efficiently carry out the bank's lending activities.

So, credit work at the bank begins in the front office. The main activity of the front office is the sale of the maximum volume of the bank's loan products, stimulation and sale of other bank products in contacts with clients, making a profit, maintaining liquidity and minimizing risks. Front office divisions interact with the bank's clients.

Table 4.2. at

Back office - the bank's divisions or individual responsible persons who, depending on their functions, provide registration, verification, reconciliation, accounting of operations and control over them. The back office carries out registration of credit and other agreements, entering information into an automated system, checking, recording and monitoring the bank's credit operations. The back office interacts with the front office departments, tax, law enforcement agencies, counterparties, and the like.

The employees of the banking institution, who are entrusted with the functions of the back office of the bank, are responsible for:

Verification of documents received from the front office on paper or electronic media regarding the accuracy of the information provided;

Registration of transactions and entering the necessary data of the automated system of the bank;

checking confirmations of transactions received from counterparties, and sending confirmation to the client about the receipt of funds;

Checking the limits for borrowers;

Reconciliation of customer account balances;

Preparation of relevant orders for settlements;

Checking the correctness of the reflection of transactions;

storing information about transactions;

Accrual of interest on loans, commissions and the like;

Control over data processing, settlements, and contracts.

During control over the implementation of the concluded loan agreements, back office workers check:

Availability of all documents on the relevant credit operation and the timeliness of their submission to the bank's credit department;

compliance of the lending operation with the requirements of legislative and regulatory legal acts of Ukraine, as well as the operational procedures adopted by the bank, established credit limits (any deviations from the established procedures and limits must be additionally agreed with the bank's management).

If violations are identified, the results of the check must be documented in an appropriate document (act, protocol, etc.).

To minimize the risk of carrying out credit operations and in order to avoid mistakes that may be made by the bank's specialists in the process of analyzing the client's creditworthiness and examining credit projects, the bank may create middle office divisions that will control the loan offers submitted by the front office. Such delineation of functions in the credit process will increase the efficiency of the bank's lending activities.

A middle office is a division of a bank that is not directly involved in operational work, but performs some general administrative and management functions. The main function of the middle office is financial control. Subdivisions of the middle office carry out:

Control over the maintenance of financial, managerial and tax accounting;

Monitoring compliance with the internal rules of the bank;

Financial forecasting of balance sheet, income statement, cash flow;

Drawing up budgets for departments, products, clients;

Assistance during the preparation of internal and external reports;

Assistance in making management decisions.

The functioning of the middle office while ensuring the bank's lending activities combines a set of analytical systems, such as a scoring policy system, a system for analyzing the effectiveness of points of sale of banking products, and the like.

There is a close relationship between the front office, back office, and middle office (Figure 4.5).

Figure: 4.5. at

Figure: 4.6

There is a clear division of functions between the divisions of the front office, back office and middle office. In particular, the front office and back office are directly involved in operational work, while the middle office carries out analysis, financial control over operations and control over risks (Figure 4.6).

So, a clear distribution of responsibilities between the bank's divisions at all stages of lending is aimed at improving the level and quality of customer service; creation of an information client base; maximum consideration in work with the borrower of a set of factors that may lead to default by him of obligations; identifying problem loans and minimizing the risks of non-repayment of credit funds and payment of interest for their use.

A new English-language word "back office" has appeared in Russian everyday life. What it is? What functions does it perform? In which companies does it exist? Let's try to figure it out in more detail.

Back office. What it is?

These units exist in many organizations. A back office is a department or department of a company that has specific functions. We are talking about routine, administrative and service. Traditionally, the functions also include information Technology (administration and support), human resources and accounting.

In some organizations, additional areas of work are separately spelled out to be performed by the back office. What is it? Often, employees of this department are engaged in statistical and analytical accounting of sales, purchases, warehouse balances and archiving.

If this back office is a subdivision of the bank, then the function includes the execution of clearing operations, current settlement and cash services, and so on.

Back office history

At the initial stages of business development, the layout of the premises of any company was special. The foreground was occupied by the so-called front office. This was done so that clients could quickly and easily find the right employee. Naturally, the management invested heavily in this space, making expensive repairs, cleaning and furnishings. The front office had to make the best possible impression, as this is the "face" of any company.

Its employees must also conform to the style of dress and behavior. This is the public side of any company.

The back office was traditionally located in the background. This is the place where the production itself was carried out, there was a system of administrative premises, various departments, warehouses, and so on.

Therefore, these territories have traditionally been dirty, gloomy and not very well-groomed. The presentability of these premises was not very well monitored, since clients never appeared in them. Naturally, there are no special requirements for the appearance of employees. More attention was paid to professional skills and abilities.

This division of the office into two large divisions that perform different functions has worked well and exists to this day.

Front office staff create a beautiful "picture" for the company. At the same time, it is thanks to the back-office staff that the development and prosperity of the company takes place. Why? Let's consider.

Significance and importance of the back office for the development of the company

Practice shows how great is the role of this unit for the organization.

First, the back office helps maintain a company's reputation in a highly competitive environment. Naturally, if employees perform their duties well and clearly. Indeed, for any client, the main criterion of a good company is a high-quality service. Thanks to the back-office employees, a full cycle of a particular operation is performed.

Second, the back office also handles risk management. What does this bring to the company? It is the employees of this department who draw up reports, select data, factors and make calculations, on the basis of which management decisions are made. Therefore, their correctness and accuracy are very important for the future of the company. Employees, on the other hand, perform extremely responsible work, significantly reducing risks.

Third, the back office is also involved in the development of new saving methods and rationalization proposals. Naturally, employees do not directly earn financial resources for the company. But they can indirectly influence this process.

Back office in the bank

It is an operational and accounting unit. Thanks to his work, the activities of the main departments are ensured.

The back office deals with accounting and registration of transactions with securities, management of liabilities and assets, as well as settlements with clients. But this is just the tip of the iceberg.

The back office carries out loan processing operations. In addition, employees are often involved in account opening, accounting and risk management.

Back office. Documentary registration and support of transactions on the securities market

In banks, the back office often consists of several divisions. Especially if the organization makes a large number of transactions in the securities market. The duties of employees include electronic and documentary registration, their support. Let's dwell on this in more detail.

Firstly, a back-office employee maintains a transaction log, draws up a sale and purchase agreement for securities of a certain issuer.

Further, the process of re-registration of securities takes place. It is about the transfer of property rights. To "start" this process, the back office employee must issue a transfer order and legalize the current transaction.

After the re-registration is carried out and the supporting document is received, the employee controls the final settlement process.

A very big responsibility is imposed on the back office employee. If there is the slightest inaccuracy in the process of paperwork, the transaction is invalidated. As a result, the client will suffer and the company will suffer serious losses.

In addition, the back office is engaged in analytical (internal) transactions between divisions in the organization in the financial redistribution system.

In recent years, for the trade sector, various back-office automation programs have often been used.

Retail back office

When organizing a business, a leader faces many challenges. It is necessary to provide the sales area with goods, to automate warehouse accounting at the enterprise, to manage pricing, to interact with suppliers and branches.

In order to solve these and many other tasks, as noted, there are special programs for the back office.

In the retail system, employees of such a department will help control the arrival and departure of goods, write off and move, revalue, make returns, cash and banking operations, and work with retail equipment.

The software package can be of different configurations: non-food retail, convenience store, mini-market or supermarket. There is currently a choice.

Back office in network trade

The main areas of work in network trading are:

- making changes and additions to a large range of goods;

- data exchange between departments;

- maintaining centralized accounting;

- receiving operational reports on the functioning of branches, etc.

To facilitate the work and ensure the interaction of the office with a network of outlets, an automated version of the back-office is often used. These programs allow the organization to work more efficiently and quickly.

Back office in catering establishments

At work for employees of the back-office of the enterprise catering mostly current operations. They traditionally include the following:

- performing routine obligatory operations;

- maintenance of commodity and warehouse accounting;

- the process of controlling the production of dishes;

- collection and analysis of data;

- making report.

Depending on the volume and turnover of the organization, the back office in trade usually numbers from three to thirteen to fifteen people.

Currently, as noted, there are automated systems to facilitate the operations to be performed by employees. This is, naturally, a positive moment for the head of the organization. But not always for workers. Practice shows that the acquisition of automated systems that perform most of the back-office work leads to a reduction in staff.